GSTR-10 Final Return

The GSTR-10 return is a final return that needs to be filed by taxpayers whose GST registration has been cancelled or surrendered. The return needs to be filed within three months of the date of cancellation or surrender of GST registration. In this blog post, we will discuss the various aspects of the GSTR-10 return, including its meaning, applicability, due date, and the procedure for filing it.

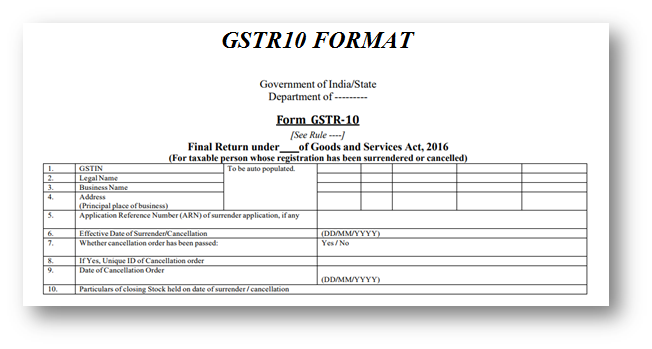

What is GSTR-10 Return?

The GSTR-10 return is the final return that a taxpayer needs to file after the cancellation or surrender of GST registration. This return is also called the "Final Return" and needs to be filed within three months of the date of cancellation or surrender of GST registration. The return contains details of the inputs and capital goods held by the taxpayer as on the date of cancellation or surrender of GST registration. It also includes details of any liabilities that are outstanding and any credit that is due to the taxpayer.

Applicability of GSTR-10 Return

Applicability of GSTR-10 Return

The GSTR-10 return is applicable to all taxpayers who have cancelled or surrendered their GST registration. Even if a taxpayer has not conducted any business during the period for which the return is to be filed, they still need to file a nil return. Failure to file the GSTR-10 return can result in penalties and interest charges.

Due Date for Filing GSTR-10 Return

The GSTR-10 return needs to be filed within three months of the date of cancellation or surrender of GST registration. For example, if a taxpayer cancels their GST registration on 1st January 2023, the due date for filing the GSTR-10 return would be 31st March 2023.

Procedure for Filing GSTR-10 Return

Procedure for Filing GSTR-10 Return

The GSTR-10 return can be filed online on the GST portal. Here are the steps involved in filing the GSTR-10 return:

- Log in to the GST portal using your credentials.

- Go to the "Returns" section and select "Final Return (GSTR-10)".

- Select the financial year for which the return is to be filed and click on "Search".

- The system will generate a summary of the return, which will include details of the tax payable, if any, and the input tax credit available.

- If there are any discrepancies or errors, you can make corrections in the return before filing it.

- Once you have verified the details, click on the "File GSTR-10" button to file the return.

- After filing the return, you will receive an acknowledgement in the form of an ARN (Acknowledgement Reference Number).

Conclusion

The GSTR-10 return is an essential return that needs to be filed by taxpayers whose GST registration has been cancelled or surrendered. The return needs to be filed within three months of the date of cancellation or surrender of GST registration. The GSTR-10 return contains details of the inputs and capital goods held by the taxpayer as on the date of cancellation or surrender of GST registration, any outstanding liabilities, and any credit due to the taxpayer. The return can be filed online on the GST portal, and failure to file the return can result in penalties and interest charges.